Solution based lending

Enquire Now - Digital applications for property lending

A faster way to get your property loan

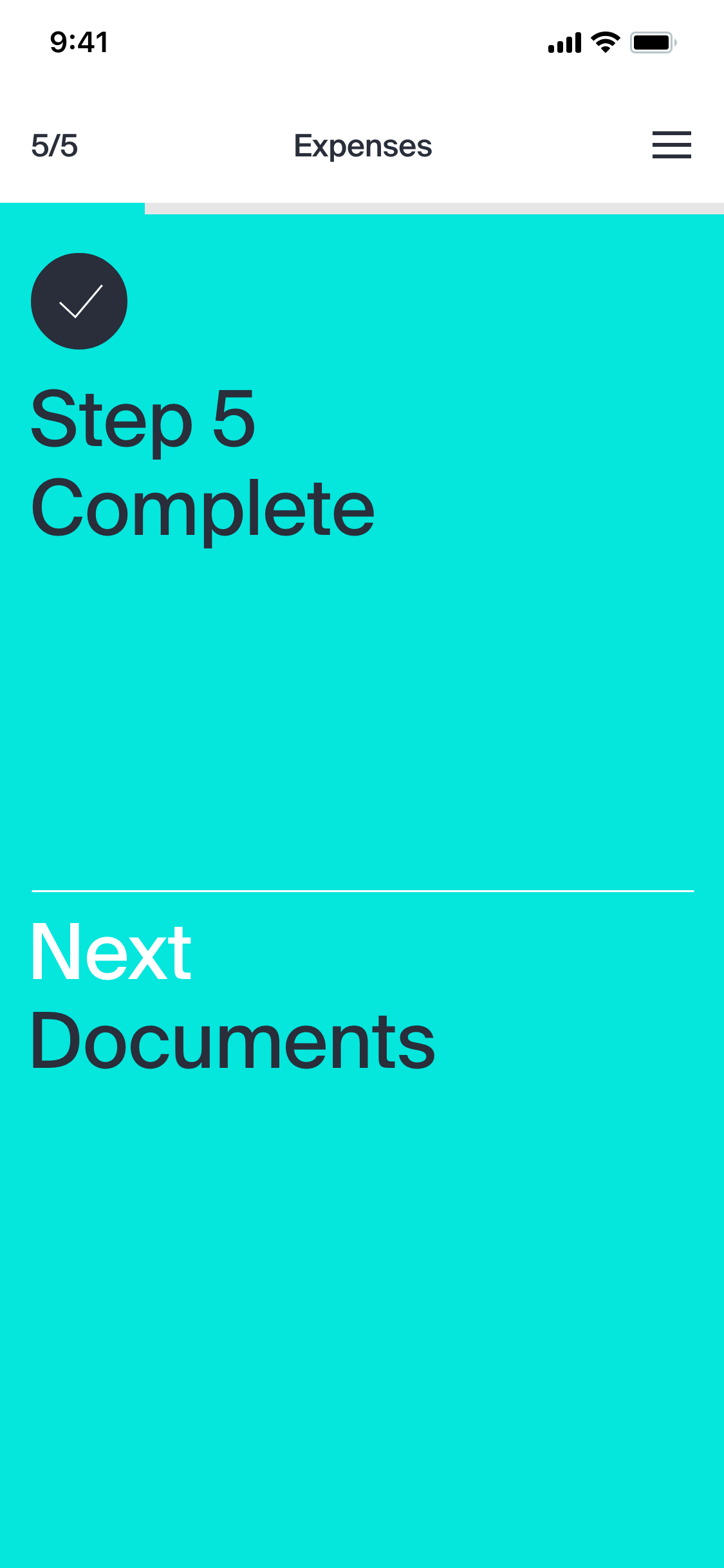

Complete your online application effortlessly using our Lending Loop Platform in just five straightforward steps. The entire process can be completed in as little as 15 minutes.

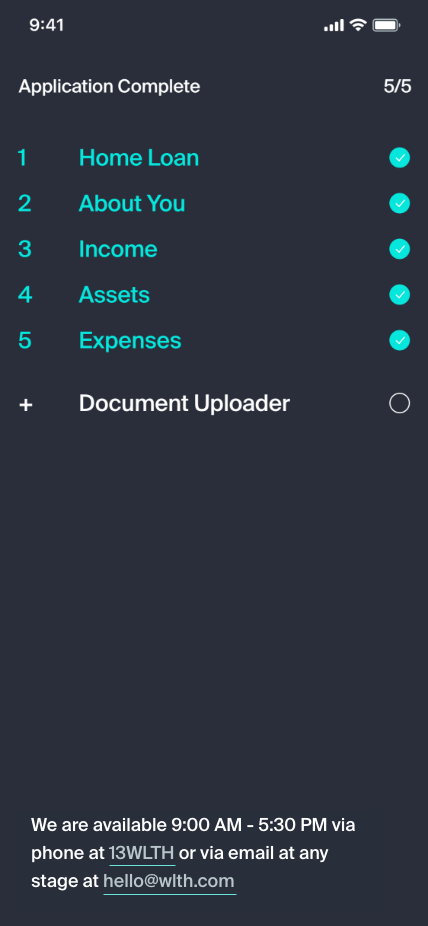

Simple 5-step process

The Lending Loop platform enables us to streamline the lending experience, to make it easy for you.

Quick & hassle-free application

Enquire Now in your own time from the comfort of your own home. It’s that simple!

Faster approval process

Our decision engine enables us to expedite the approval process, ensuring that your loan is settled promptly

Low rates & great service

We may be branchless, but not faceless. We offer great rates coupled with expert support.

WLTH LEND

Highly

competitive

home loans

Comparison Rate from

5.86% P.A*So much more than straightforward lending

Our team understands everyone is different. We tailor the loan to suit you and not the other way round!

- Flexible Lending options.

- Lower rates and faster approvals.

- Don’t be limited to 20% minimum deposits and tough criteria to access great rates.

- Available via Finance Brokers

- Earn WLTH+ loyalty points when you pay on time. (Coming in 2024)

WLTH LEND

A

simplified and faster application process

WLTH LEND

Be prepared. Information you will need handy to apply.

-

Enter your details using the simple

5-step online form. - Tell us about your assets & expenses.

- Upload key documents & verify ID.

-

Our lending specialists are available

5 days for support & assistance. - Or ask your Finance Broker about WLTH.

WLTH LEND

Applying for a loan couldn’t be simpler

Have you ever wanted to just apply for a loan yourself without having to go to a bank branch or meet with a broker?

We thought so too, that’s why we give you the option to apply from the comfort of your own home in your own time!

Enquire NowWLTH LEND

Applying usually takes around

15 minutes

Residential property

Am I eligible for a Loan?

So much more than straightforward lending

We explore every option to find a product to suit you. Our team understands everyone’s circumstance is different, so we can tailor your loan to best suit you.

- Flexible lending options.

- Lower rates and faster approvals.

- Don’t be limited to 20% minimum deposits and tough criteria to access great rates.

- Earn WLTH+ loyalty points when you pay on time. Be rewarded for good conduct! (Coming in 2024)

Checklist

To be approved for one of our loans you’ll need to:

- Enter your details using the simple

5-step online form. - Tell us about your assets & expenses.

- Upload key documents & ID verification.

- Our lending specialists are available

5 days for support & assistance.

Residential property rates

Enter your loan amount to calculate repayments.

Home Loan P&I

Repayments

- Principal & Interest

- Up to 95% LVR

- No application fees

- E-Offset Account

Investment P&I

Repayments

- Principal & Interest

- Up to 95% LVR

- No application fees

- E-Offset Account

Generate a Key Facts Sheet for one of our P&I loans.

Investment IO

Repayments

- Interest Only

- Up to 90% LVR

- No application fees

- E-Offset Account

Investment SMSF

Repayments

- Principal & Interest

- Up to 90% LVR

- Optional E-Offset Account

- Commercial Security Available with Additional Rate Loading

* The comparison rate is based on a loan of $150,000 over a term of 25 years. WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

Protection

Ensuring ethical standards

The National Consumer Credit Protection Act 2009, or the NCCP Act, is legislation that’s designed to protect consumers and ensure ethical and professional standards in the finance industry.

Lenders and mortgage brokers must hold a credit licence or be registered as an authorised credit representative and must adhere to the rules set out in the NCCP Act.

The NCCP Act is regulated and enforced by ASIC (Australian Securities Investment Commission) in accordance with the National Credit Code (NCC).

We are also registered through our licencee to the EDR scheme, AFCA, the Australian Financial Complaints Authority under number 787770.

Visit Website